Aptos hits new peaks at 4.1M weekly active addresses and $1.25B in TVL

Aptos Weekly Overview - December 5, 2024

Welcome back to Aptos’ Weekly Overview. The best place for Aptos community members to get up to speed on the chain’s latest updates, metrics, releases, insights, ecosystem developments and more. All in one place.

New here? Subscribe here to get updates to your inbox. Every Thursday. 🔔

By The Numbers

Aptos transactions this week: 4.2M (-82.9%)

Network transactions per second (TPS): 53.5

Active users: 891.4K (-70.5%)

New users this week: 182.4K

Total staked APT: 895.41M (+0.1%)

Aptos total value locked (TVL): $1.2B (+4.9%)

NFT weekly sales: 5.1K (+0%)

The percentages and metrics are based on a 7-day timeframe from Flipside data as of Dec. 3, unless noted otherwise.

Inside the blockchain

🌐What happened: Aptos hit 4.1 million weekly active addresses and $1.25 billion in TVL on Dec. 4, according to data on Artemis and DefiLlama

🌐Why does it matter: This marks the second consecutive week that the network hit all-time highs for its weekly active addresses. The network saw 3.9 million weekly active addresses on Nov. 27, marking its prior all-time high. However, this metric was pushed higher by 200,000 addresses this week. This points toward the notion that users are consistently returning – and entering – the network for their onchain decentralized finance (DeFi) needs.

Furthermore, Aptos saw an increase in its TVL, hitting a new high of $1.25 billion. This also aligns with the network’s current trend ofconsistently hitting new all-time highs this year. Since mid-October, when its TVL was $622 million, the metric has nearly doubled. This growth is arguably fueled by Aptos’ expanding presence in the DeFi sector and its partnerships with Tether, Bitwise, Blackrock and more.

Additionally, consistent weekly active address and TVL metrics can be attractive metrics for new developers and users when considering what blockchain to decide to use.

🌐The big picture: Across the ecosystem, a lot of blockchains are far from its peak in terms of weekly active addresses and TVL. However, if the Aptos network is able to consistently reach new milestones, it can signal a healthy level of adoption from DeFi developers and users alike.

If more value is brought in by DeFi projects, then the Aptos ecosystem can anticipate even more increase in users and potential developers. As market data and the trend shows, Aptos has maintained and captured market share as users interact with the network by consistently returning and adding liquidity to it.

Ecosystem wins

AGDEX deployed the mainnet version for its Aptos-powered decentralized perp exchange

Cellana Finance shared it passed $100M in TVL for its Aptos-powered DEX

STAN, a web3 gaming platform built on the Aptos network, hit 100K unique active wallets on Nov. 28 data on DappRadar shows

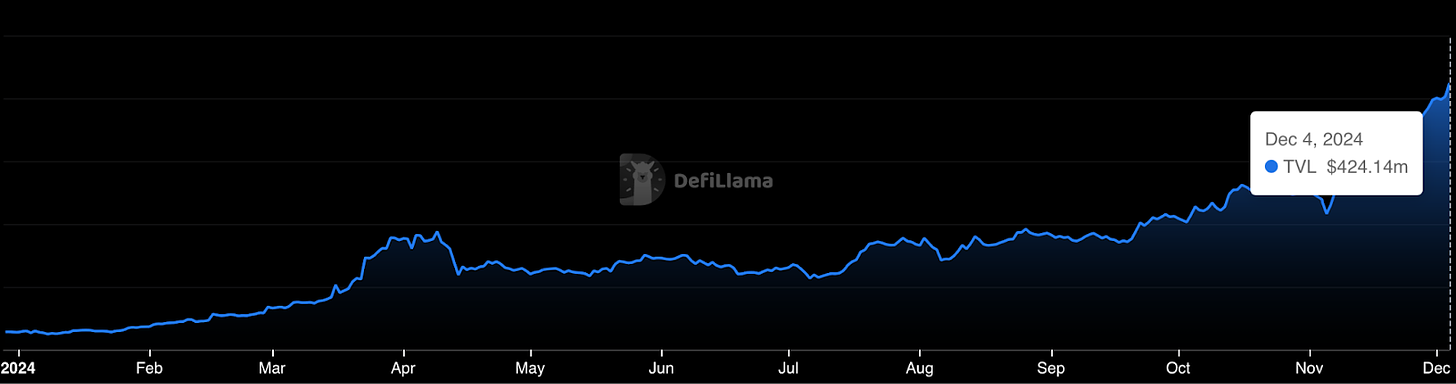

Aries Markets hit $424M in TVL on its Aptos-centric margin trading protocol (shown below)

Source: DefiLlama

The community is makin’ Moves

Emojicoin hosted an X spaces with Aptos Labs about the community’s latest happenings

Pyth Network created a thread on X about Aries Markets and the Aptos network

“Podcats” launched its onchain podcast platform so users can collect and access Aptos-centric X spaces in one place

By the headlines

You might have seen these Aptos-related headlines recently…

Aptos Financial Ecosystem Analysis (Messari)

AI training consent a ‘perfect use case’ for blockchain — Aptos co-founder (Cointelegraph)

Join in the fun

Want to dive into the ecosystem full-time? Find the latest job postings on Aptos Foundation here.

Check out details here for Panora’s December campaign in collaboration with Merkle Trade and Emojicoin

Loonies released a thread on X about its referral program and how to get involved in its ecosystem

To get this newsletter delivered to your inbox every week, subscribe here.

This product was built by Token Relations.

This information is for entertainment purposes only. It should not be considered financial advice, nor should it be used to make investment decisions. Cryptocurrencies are high risk and you should consult a financial professional before making any financial decisions. Make sure you do your own research.