Aptos TVL hits new peak at $642M, up 102% since August

Aptos Weekly Overview - October 10, 2024

Welcome back to Aptos’ Weekly Overview. The best place for Aptos community members to get up to speed on the chain’s latest updates, metrics, releases, insights, ecosystem developments and more. All in one place.

New here? Subscribe here to get updates to your inbox. Every Thursday.

By The Numbers

Aptos transactions this week: 27.4M (+22.1%)

Network transactions per second (TPS): 45.2

Active users: 2M (+33.5%)

New users this week: 1.3M

Total staked APT: 844.1M (+0%)

Aptos total value locked (TVL): $618M (+5.4%)

NFT weekly sales: 3.2K (+9.1%)

The percentages and metrics are based on a 7-day timeframe from Flipside data as of Oct. 7, unless noted otherwise.

Inside the blockchain

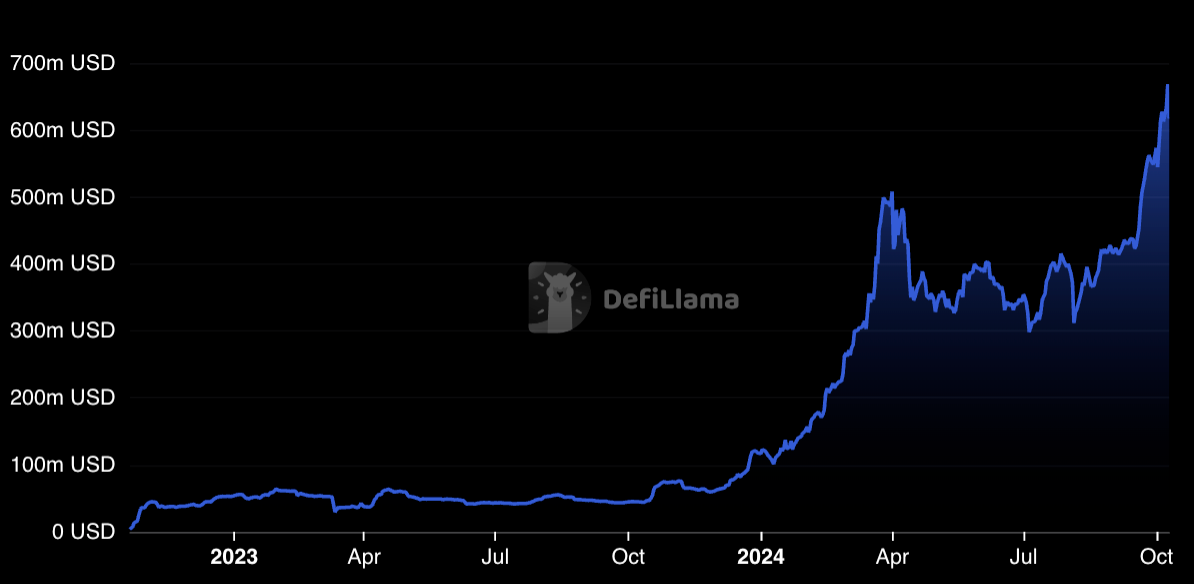

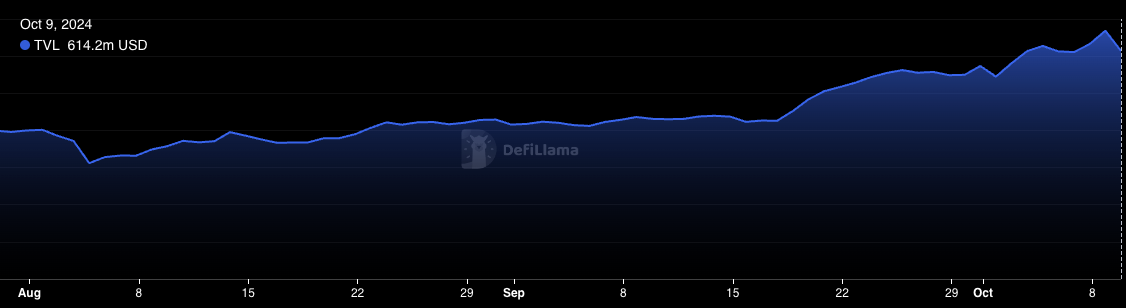

🌐What happened: The Aptos network hit an all-time high of about $642 million in TVL on Wednesday, according to DefiLlama data.

🌐Why does it matter: The amount of TVL on Aptos has rose 106% since early August from about $312 million TVL. The previous peak was on March 31 at $508 million, the data shows.

It’s not uncommon for TVL to fluctuate, especially between market cycles or new DeFi initiatives being integrated into the market. While Aptos’ TVL retreated between April and August, it has seen a huge spike in activity in the past four to eight weeks.

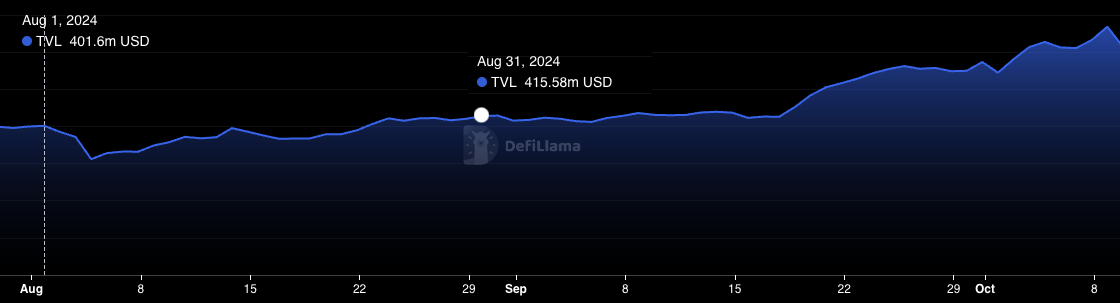

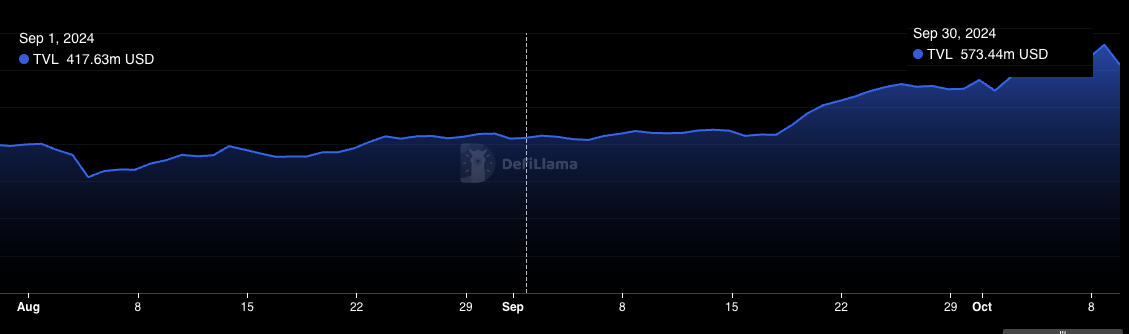

At the beginning of August, Aptos’ TVL was about $402 million. Its TVL increased 3.59% by the end of the month at $416 million. However, in September this metric spiked, especially in the last week. The TVL rose 31.58% from about $418 million to $550 million. Since then, the data has been on an upward trend.

This scale is arguably fueled by Tether announcing it was bringing USDT on Aptos in August, as well as the development of ecosystem DeFi projects such as Aries Markets, Amnis Finance, Thala, and more.

🌐The big picture: Across the ecosystem, a lot of blockchains are far from peak TVLs. But Aptos is one of the chains standing out on this front.

If the network continues to reach new TVL milestones, it can signal a healthy level of adoption from DeFi projects and users.

As market data shows, the amount of TVL on the Aptos network has been on an upward trend since the beginning of August. If more value is brought in by DeFi projects, then the Aptos ecosystem can see an increase in users and potential developers.

Similar to other networks, a high TVL count can be an attractive statistic for people who want to explore DeFi opportunities or launch their dApp on a chain.

Ecosystem wins

Aptos announced its Aptos Improvement Proposal, which are community meetings focused on collaborative network development

And speaking of TVL…

Amnis Finance, an Aptos liquidity staking platform, hit a new peak of $215M TVL on Oct. 5, according to DefiLlama data

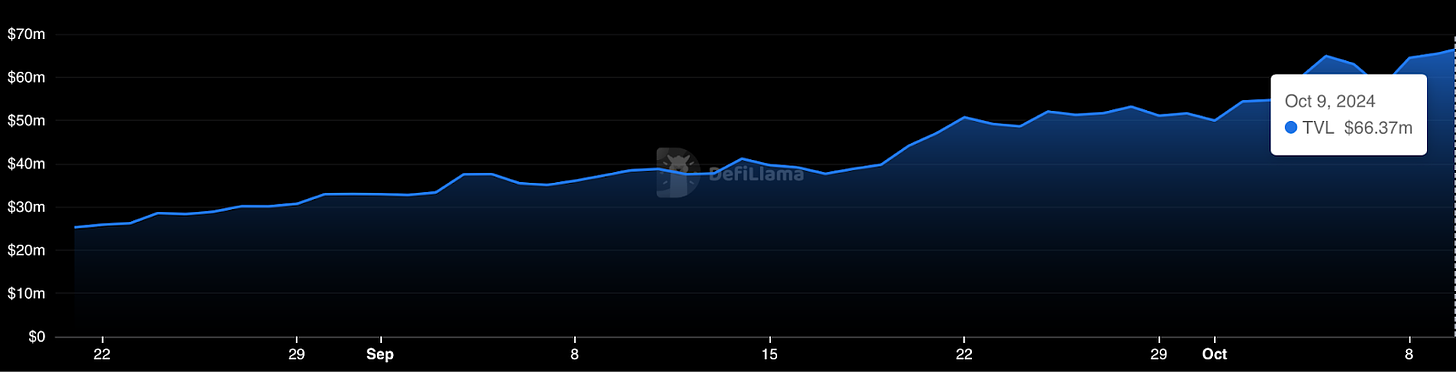

Cellana Finance, a community-owned DEX on Aptos, hit $66.37M in TVL (shown below)

The community is makin’ Moves

ERAGON hosted a stream showcasing various web3 games its platform features

Learn more about Aptos and its network capabilities in a thread by X user 0xdefi_MCK

Econia Labs shared its monthly roundup, highlighting new asset support, partnerships, product developments and more

By the headlines

You might have seen these Aptos-related headlines recently…

Building verifiably high-throughput blockchain with Aptos CTO Avery Ching (Logan Jastremski Podcast)

“THIS Is Exactly How Crypto Goes Mainstream” - Mo Shaikh (The Wolf Of All Streets Podcast)

Aptos ecosystem guide: top Aptos projects and protocols to watch (OKX Blog)

The First and Only US-Registered Fund to Use Public Blockchains (Mo Shaikh on TradeTalks)

Join in the fun

Want to dive into the ecosystem full-time? Find the latest job postings on Aptos Foundation here.

Aptos’ global hackathon Code Collision has applications open until Oct. 15 - apply here

Relisten to the “Aptos After Dark” spaces to learn more about the different ecosystem projects

ICYMI: Aptos Labs hosted its developer office hours featuring its founding engineer team

To get this newsletter delivered to your inbox every week, subscribe here.

This product was built by Token Relations.

This information is for entertainment purposes only. It should not be considered financial advice, nor should it be used to make investment decisions. Cryptocurrencies are high risk and you should consult a financial professional before making any financial decisions. Make sure you do your own research.